Budgeting for Couples: Top 5 Tips to Manage Finances Effectively

Discover the ultimate guide to successful budgeting for couples with our 5 practical tips. Learn how to strengthen your finances and your relationship!

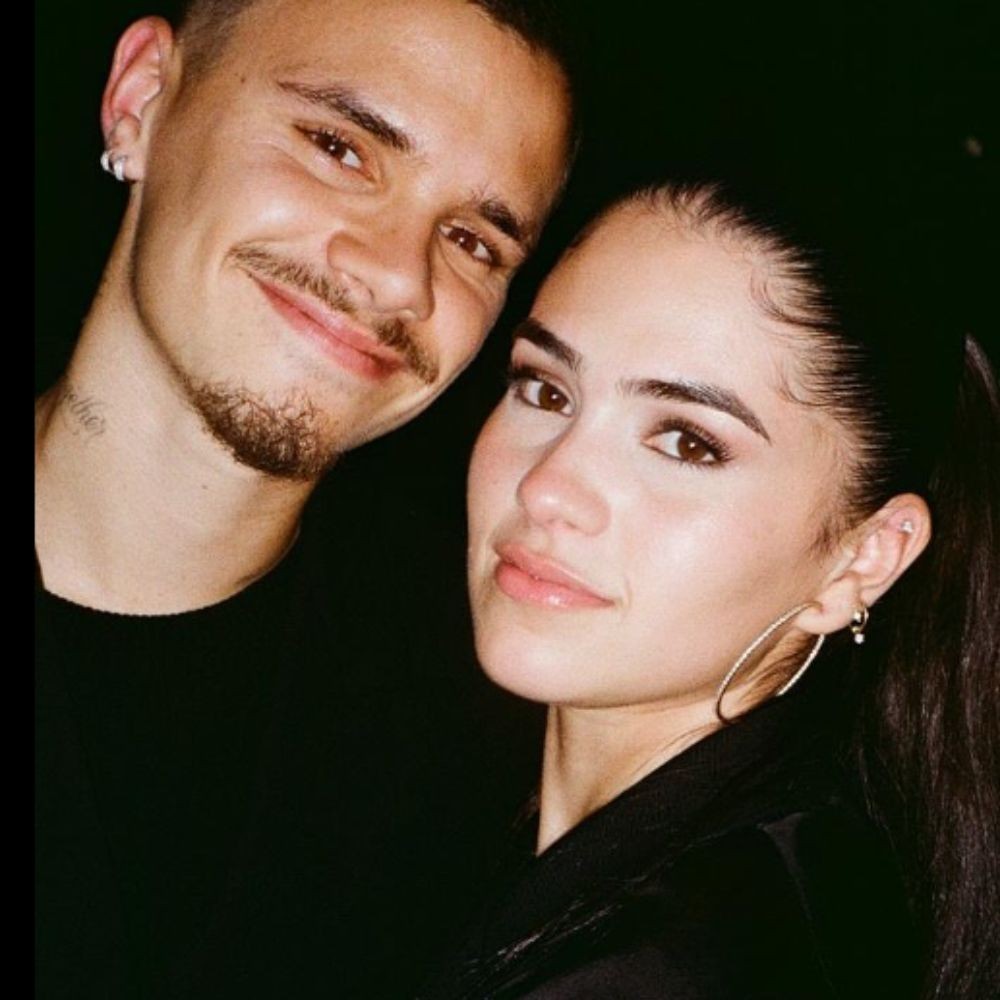

When it comes to love, a few things can affect your relationship negatively, one of which is disagreements over money. Our contributor Chris Pleines, Dating expert at Dating Scout - a dating site, says, “Financial stress is undeniably a significant strain on relationships. Disagreements often arise from differing spending habits, debt concerns, or varying financial upbringings. The tension might restrict enjoyable activities, create feelings of insecurity about the future, or even lead to hidden expenses that can erode trust.”

The truth is that you and your partner may not always agree on financial issues, but that does not imply your relationship is doomed to fail. In fact, setting up and adhering to a couple’s budget can do wonders for strengthening the bond between you and your sweetheart. When it comes to budgeting for couples, the key is to create a strategy that works for both of you. Remember that a budget is a blueprint for managing your finances. As with any blueprint, it should be carefully scrutinized, refined, and reviewed regularly to guarantee that you meet your ultimate objectives.

5 Essential Budgeting Tips for Couples

As the old saying goes, two heads are better than one, and this is especially true when it comes to managing finances in a marriage or long-term relationship. Uniting your life often means combining your finances, and it's not always easy to navigate budgeting as a couple.

However, taking the time to have those important conversations about money is crucial to building a strong financial foundation together. If you don't know where to begin, here are some tips to help you better understand how to budget as a couple.

1. Determine Your Actual Combined Income

The most significant factor to consider while managing your money is your income. Your income should be stated first on your budget because it serves as the foundation for all subsequent financial decisions.

To begin creating your budget, you must first identify all of the sources of income that you and your partner anticipate receiving within a specific time frame. A week, two weeks or even a month is possible. It's important to consider every potential income stream and list them out to have a clear overview of the financial resources at your disposal.

Don't limit your income sources to your regular salary. Income can come from multiple sources like side hustles, bonuses, dividend income, rental income, royalties, and refunds. After you've compiled a list of all potential sources of income, estimate how much you'll earn from each.

Adding up all of your revenue streams offers you a clear picture of how much money you'll have available to cover expenses during the budgeted period. Keep this number at the top of your budget and remember that your costs should never surpass it.

2. List Down All Your Joint Expenses

Once you’ve tallied up your total income, it’s time to jot down your anticipated expenses. Certain monthly expenses, such as rent or mortgage payments, grocery bills, and utility charges, will remain consistent. To stay on top of these recurring costs, they can be grouped into the 12 typical household budgeting categories.

The 12 most common household budgeting categories are:

1. Saving

2. Investing

3. Housing

4. Transportation

5. Utilities

6. Food

7. Personal Care

8. Medical/Health

9. Insurance

10. Household goods/supplies

11. Debt repayment

12. Entertainment/Fun

By categorizing your expenditures, you may not only organize your budget but also see where your money is going. Simply assign each expenditure to the category it fits in. For instance, your “housing” category could include your mortgage payment, HOA fees, landscaping expenses, and property taxes.

Even if an expense isn’t incurred each budgeting cycle, you can still add it to your standard list of expenses.

3. Calculate How Much You Will Spend on Each Item

It is crucial to remember that recurring expenses are not necessarily the same. That's why reviewing your expenses each time you create a new budget is crucial. Additionally, creating a list of expenses can reveal opportunities for reduction, freeing up cash for other expenditures.

Expenses are best calculated by taking an average of previous expenditures over a certain time period. For example, by averaging your grocery costs for the past three months, you can estimate your upcoming monthly expenses.

Some expenses are fixed, and their exact amount can be found on billing statements. For others, you will have to determine a realistic limit based on what you can afford.

Once you have tallied up your estimated expenses, subtract this total from your anticipated income. If you exceed your expected income, adjust your expenses accordingly. On the other hand, if you have additional funds, allocate them towards savings or paying off debt.

4. Keep Your Expenses in Track

When it comes to budgeting for couples, tracking your expenses is absolutely crucial. You won't know if you're staying inside your budget unless you track your spending. Thankfully, there are two easy methods for you and your partner to keep tabs on your expenses:

Firstly, shared budgeting spreadsheets for couples can be incredibly helpful. Simply save your budget spreadsheet on Google Drive or Dropbox so that both you and your partner can reference or edit it whenever needed. There are also plenty of great couple’s budget templates out there that you can use as a starting point.

Budgeting apps, on the other hand, can be game changers. You may simply track your spending in real time by connecting your bank account and debit cards to an app. These apps will even sort your expenses into different categories and alert you when you're close to your budget limit.

To keep your records accurate, make sure to record your expenses either as they occur or at set intervals throughout the day.

5. Arrange a Recurring Budget Meeting

Successful budgeting for couples requires open communication, regular revisions, and teamwork. Instead of leaving it up to chance, establish a consistent budget meeting with your partner.

Make this an enjoyable experience by cooking a delicious meal and setting a comfortable environment. Take the time to review your current expenses and anticipate upcoming bills and costs. By planning, you can strategically allocate your finances and ensure that you are meeting your financial goals.

The ultimate goal of this meeting is to create an agreed-upon couple’s budget for the upcoming period that will guide your financial decisions. Record this budget and keep it visible as a reminder of your shared goals and progress.

With these budgeting ideas for couples, managing your finances can become a stress-free and productive activity that brings you closer together.

Benefits of Budgeting as a Couple

When you hear the word budget, it's easy to envision overwhelming calculations, unwelcome limits, and confronting questionable financial decisions of the past. For couples looking to merge their finances, it can also seem like a recipe for heated debates about their differing spending habits.

As per our contributor Chris Pleines, budget planning helps a couple stay financially strong. He adds, “Budget planning involves strategizing how to allocate and save money based on a couple's income and expenses. By doing so, couples can reduce financial stress, align their financial goals, foster open communication and trust, and ensure overall financial stability. Collaborative planning and regular updates are key to an effective budget, which in turn reinforces a strong relationship foundation.”

Budgeting can be a beneficial tool for couples looking to get control of their home finances and reach their financial objectives. Yes, it may require some uncomfortable conversations, but these can prevent more difficult discussions in the future.

Here are some reasons why budgeting for couples is beneficial:

1. May Help You Achieve Better Control Over Your Spendings

Mastering the art of couple budgeting is all about setting priorities. Once you and your significant other have identified the must-haves every month (like groceries, utility bills, car payments, and rent), you can plan out how much you have left over for fun expenses. Believe it or not, having a budget can actually provide more spending flexibility.

If one of you is a better financial wizard than the other, it's entirely good for them to take charge of bill management. But it's important for both parties to regularly check in and review the budget together. You may hold each other accountable and have a say in how money is allocated this way.

2. May Help You Prepare for Emergencies

Experts recommend saving at least three months' worth of living expenses in an emergency savings account to prepare for unanticipated catastrophes. This will serve as a safety net in the event of job loss, sickness, injury, or unanticipated bills such as auto or home repairs or medical operations.

For couples looking to establish an emergency fund, it's helpful to first create a budget and determine how much can be put aside each month towards the fund. Having a strategy in place and being able to prioritize costs can help ease financial stress.

3. You Can Establish Both Short And Long Term Goals

When working together as a couple, the most enjoyable part of budgeting is choosing your future priorities. This includes making decisions about saving for a new home, planning for a family, embarking on a dreamy cruise, or even starting your own business. By budgeting as a couple accordingly, you'll be able to stay on track and turn your dreams into a reality. Regular check-ins on your spending will help you to stick to your strategy and achieve your shared goals.

4. May Help Reduce Your Stress Levels

Sure, the knowledge of your exact financial situation and where your money is going, or not going, every month can trigger a degree of anxiety, particularly if your finances are in turmoil. But ignorance is not bliss.

When you add up your expenses and earnings, it may not be as awful as you anticipated. Furthermore, having a couple's budget will allow you to make necessary adjustments if you find yourself in a bind. It's challenging to make progress without any way to track it, and a budget will help you stay on top of your financial game.

5. You Can Talk About Something Beyond Work

Looking for something more to chat about with your partner other than work? Creating a budget together can be a great starting point. You'll be able to monitor your spending habits on a regular basis and decide whether any changes are required.

You can also take the opportunity to plan for such unexpected expenses and track your progress toward your long-term financial goals. So, set aside some time and get budgeting — you never know what conversations it might spark.

Conclusion

Money, as they say, cannot buy love. However, it can have a significant impact on any relationship. Money fights are all too common in relationships, but they don't have to be. With these practical tips for successful budgeting for couples, you and your significant other can get on the same financial page and conquer any money obstacle that comes your way. Think of the peace of mind that comes from knowing you and your partner are working towards the same financial goals.

By following these couple budgeting tips, you'll not only avoid financial stress but also enjoy a stronger, more unified relationship. So go ahead, put these budgeting tips into practice, and watch your love grow stronger with every penny you save together.

Contributor: Chris Pleines, Dating expert - Datingscout

ALSO READ: 10 Rules of Live-in Relationships That Couples Must Follow

JOIN OUR WHATSAPP CHANNEL

JOIN OUR WHATSAPP CHANNEL