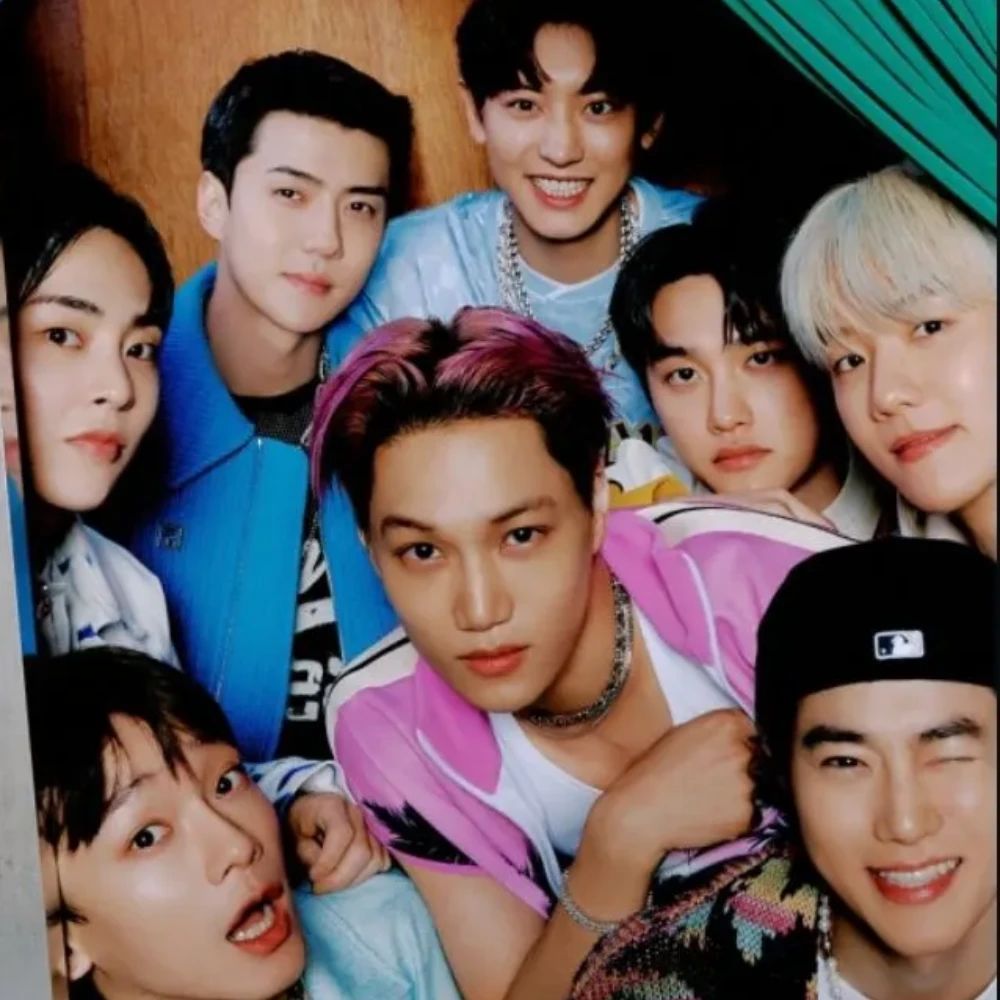

BTS’ meager HYBE IPO shares stir new concern amid Bang Si Hyuk’s 400 Billion KRW stock fraud probe

BTS’ small HYBE IPO shares raise questions as Bang Si Hyuk is investigated for 400 billion KRW stock fraud, sparking debate over fairness in profit sharing.

BTS and HYBE's chairman, Bang Si Hyuk, is under investigation for insider trading, which has sparked fresh outrage. BTS fans are once again questioning how little the group received during the company’s massive IPO in 2020.

While this has major legal and financial implications, it has also reignited an emotional debate. Fans are now revisiting how little BTS received in comparison.

Before the IPO, Bang Si Hyuk granted each BTS member around 68,000 HYBE shares. That’s 478,695 shares in total for all 7 members. At the time, the shares were worth about 64.6 billion KRW (roughly USD 46 million). Each member received an estimated 9.2 billion KRW (approx. USD 6.7 million).

In 2021, three members, Jin, J-Hope, and RM, sold part of their holdings. They earned between 1.8 billion and 4.8 billion KRW each. As of September 2023, BTS members became private shareholders. It’s unknown whether they still hold their original shares.

Based on last year’s stock prices, those shares could now be worth about 15 billion KRW per member. That’s roughly USD 11 million each. Still, it doesn’t compare to the hundreds of billions earned by Bang and others close to him.

Several individuals tied to the equity fund also reportedly profited. Some took home 100 billion to 200 billion KRW. This sharp gap in profit has angered many.

Why are fans angry over Bang Si Hyuk?

BTS is widely seen as the reason for HYBE’s global success. Fans say it’s unfair that the group received only a fraction of the financial reward. Many are now challenging Bang Si Hyuk’s carefully maintained image as the “father of BTS.”

They're questioning how insiders walked away with hundreds of millions, while BTS got what some call “breadcrumbs.”

HYBE Chairman Bang Si Hyuk's Share Scandal

On May 28, South Korea’s Financial Supervisory Service (FSS) confirmed it is looking into Bang Si Hyuk for possible financial misconduct. According to Newsen, Bang Si Hyuk told early HYBE shareholders in 2019 that the company had no plans to go public. Based on that information, many sold their shares.

But just months later, HYBE moved forward with its public listing. The shares those investors gave up ended up in the hands of a private equity fund. That fund was closely tied to Bang himself. He had a contract ensuring he would receive 30% of the fund’s profit from the IPO.

The result? Bang Si Hyuk reportedly earned around 400 billion KRW—roughly USD 300 million—after HYBE went public in October 2020.

The Financial Supervisory Service (FSS) believes this may constitute illegal insider trading. The case is currently under review and may be handed to prosecutors for formal investigation.

Financial experts note that executives often set up favorable terms before an IPO. But when misinformation is involved, ethical and legal boundaries are crossed.

As the investigation unfolds, the spotlight is not just on Bang Si Hyuk. It’s also on the wider system—one where massive profits often stay at the top, even when they’re built on the backs of global stars like BTS.

What is an IPO share?

When a company wants to sell part of itself to the public for the first time, it is called an Initial Public Offering, or IPO.

During an IPO, the company sells shares, which are small pieces of ownership in the company. People who buy these shares own a part of the company.

This helps the company get money to grow and lets regular people invest in it as well.

For example, HYBE, the company behind BTS, sold shares to the public in 2020 during its IPO. That’s when people could buy a part of HYBE for the first time.

JOIN OUR WHATSAPP CHANNEL

JOIN OUR WHATSAPP CHANNEL