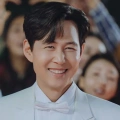

Will BTS' agency chairman Bang Si Hyuk face life in prison? Inside 400 Billion KRW stock scandal shaking HYBE

HYBE founder Bang Si Hyuk faces potential criminal investigation over a controversial 400 billion won pre-IPO deal. Read more about the serious fraud allegations.

South Korea’s financial watchdog is intensifying its probe into HYBE (BTS label) chairman Bang Si Hyuk. Reports emerged that the Financial Supervisory Service (FSS) is preparing to formally request a criminal investigation. The matter revolves around a potentially illegal transaction from 2019.

It is allegedly tied to misleading investment practices and undisclosed profit-sharing arrangements, raising serious concerns under the Capital Markets Act. The case centers on a 400 billion KRW (approximately 290 million USD) deal. It could, if proven to be fraudulent, expose the entertainment mogul to severe legal penalties, including life imprisonment.

Allegations of deception in pre-IPO activities surface

At the heart of the investigation is a claim that Bang Si Hyuk, prior to HYBE’s public listing, intentionally misled investors about the company’s IPO plans. According to sources within the financial industry, the FSS’ Investigation Department 2 has uncovered evidence. It suggests that in 2019, Bang told HYBE shareholders that there were no immediate plans to go public.

This assurance reportedly led some investors to sell their shares, unaware that the company was quietly progressing toward an IPO. In reality, HYBE was taking strategic steps indicative of an imminent public offering, including applying for a designated auditor. The shares were allegedly purchased by a private equity fund (PEF) created by an associate of Bang Si Hyuk. It is an entity with which he is now believed to have had undisclosed financial ties.

Secret profit-sharing agreement uncovered

Further investigation by the FSS reportedly revealed that Bang had entered into a private profit-sharing agreement with the aforementioned PEF. This deal allegedly allowed Bang to personally collect around 30% of the fund’s profits. This ultimately earned him an estimated 400 billion KRW through the transaction.

Critically, these arrangements and financial benefits were not disclosed in HYBE’s IPO registration documents. Regulators believe this lack of disclosure may qualify as fraudulent and unfair trading.

Multiple authorities now involved in the investigation

As the FSS prepares for its investigation, reports indicate that the agency will submit a fast-track referral to the prosecution. The fast-track mechanism is typically reserved for high-priority cases involving large-scale financial misconduct. Simultaneously, the Financial Crime Investigation Unit of the Seoul Metropolitan Police Agency is also conducting a parallel investigation.

The case has gained momentum months after initial media reports questioned potential irregularities surrounding HYBE’s IPO. Initially treated as a disclosure-related issue, the matter has since been reclassified as a full-fledged securities fraud investigation.

Legal ramifications could be severe

The implications of the case are profound. If authorities confirm that the alleged profits were indeed earned through illegal means, Bang Si Hyuk could face punishment under Article 443 of the Capital Markets Act. This statute mandates a minimum sentence of five years, and in cases where unlawful profits exceed 5 billion KRW, the court may impose life imprisonment.

A spokesperson for HYBE has issued a brief statement asserting that all business dealings were conducted under legal supervision and adhered to the boundaries of current laws. However, that has not eased growing scrutiny from both regulators and the public.

ALSO READ: HYBE decides to sell 243 billion KRW stake in SM Entertainment to THIS Chinese company

JOIN OUR WHATSAPP CHANNEL

JOIN OUR WHATSAPP CHANNEL