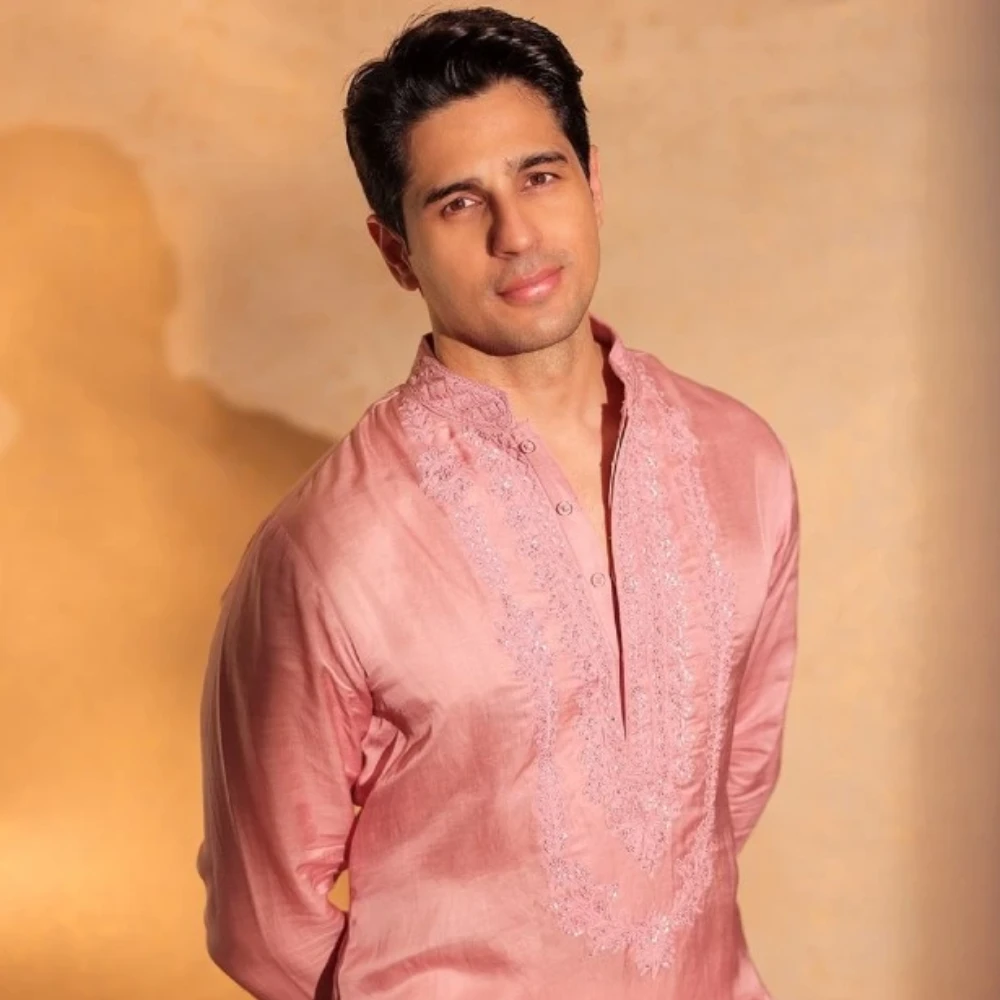

Bang Si Hyuk 400B KRW Stock Fraud Probe: Prosecutors reject 2nd raid on BTS' agency HYBE, know what’s next

Prosecutors deny police a second warrant to raid HYBE HQ amid Bang Si Hyuk fraud probe. FSS claims he hid a 400B KRW deal and misled investors before the IPO.

There is a significant development in the ongoing financial investigation involving HYBE founder and chairman Bang Si Hyuk. South Korean prosecutors have once again denied a police request to search HYBE’s headquarters. The request was submitted as part of a deepening probe into potential securities fraud.

The Seoul Southern District Prosecutors’ Office refused to issue the warrant, offering no official explanation for their decision. This marks the second time investigators have been blocked from obtaining physical evidence from the entertainment giant’s offices.

Police’s next plan

This is not the first time police have tried to obtain a warrant. Their initial request was submitted in April but was turned down by the prosecution. After collecting additional testimony and reviewing financial records, authorities submitted a revised application. They were hoping for a different outcome, only to be met with the same rejection.

According to sources within law enforcement, prosecutors may believe the current evidence lacks the weight needed to justify a raid on HYBE’s offices. That hasn’t stopped the police, who are said to be preparing a third and more detailed warrant request.

The core of the case

The investigation centers around a 400 billion KRW (approximately 293 million USD) transaction. It took place in 2019, a year before HYBE’s initial public offering. According to The Korea Economic Daily, the Financial Supervisory Service (FSS) uncovered key documents in the case. These suggest that Bang Si Hyuk encouraged early HYBE shareholders to sell their stakes. The buyers were reportedly a private equity firm run by one of his acquaintances.

The controversy lies in what Bang allegedly failed to disclose: a secret 30% commission he received from the deal. It effectively earned him hundreds of billions of won while keeping investors in the dark. These profits reportedly did not appear in HYBE’s official financial disclosures filed ahead of the IPO.

Misleading investors before IPO?

Multiple shareholders have since come forward, alleging that Bang explicitly downplayed any plans for an IPO when persuading them to sell their shares. These investors claim they made financial decisions based on incomplete or misleading information. They were unaware that Bang and his team were already working behind the scenes to prepare HYBE for a stock market debut.

Documents obtained by the FSS reportedly show that HYBE had begun securing audit certifications, legal consultations, and IPO-related filings at the time the shares were being sold. It directly contradicts what Bang allegedly communicated to shareholders. Once HYBE went public, its valuation soared, leaving those who sold early feeling duped and financially disadvantaged.

Could Bang face jail time?

The case is now being examined under the lens of South Korea’s Capital Market Act. It prohibits the use of insider information and mandates full disclosure of any financial arrangements that may affect shareholder value.

If prosecutors determine that Bang knowingly misrepresented HYBE’s IPO intentions, he could be charged with securities fraud. The crime carries penalties ranging from hefty fines to life imprisonment.

JOIN OUR WHATSAPP CHANNEL

JOIN OUR WHATSAPP CHANNEL